In an increasingly complex and interconnected global economy, navigating the intricacies of personal finance, investment, and legacy planning can feel like charting a course through uncharted waters. This is where wealth management steps in, evolving beyond traditional financial advice to offer highly personalized, holistic strategies designed to cultivate, preserve, and grow an individual’s financial well-being over a lifetime and across generations. Far from a one-size-fits-all solution, modern wealth management crafts bespoke growth paths, deeply attuned to unique aspirations, risk tolerances, and life stages. It’s about empowering individuals and families to achieve their financial dreams through a comprehensive, integrated approach that addresses every facet of their financial life, creating truly personalized growth paths for enduring prosperity.

The Evolution of Financial Guidance: From Transaction to Transformation

To truly appreciate the comprehensive nature of modern wealth management, it’s essential to understand its evolution from simpler forms of financial advice to the multi-faceted discipline it is today.

A. Traditional Financial Planning: Early Approaches

Historically, financial guidance often revolved around specific transactions or limited scopes, lacking the integrated view that modern wealth management offers.

- Brokerage Services: Early financial services were often transaction-oriented, focusing on buying and selling stocks, bonds, or mutual funds. The advice was typically product-specific, driven by commissions, and less about the client’s overall financial picture.

- Basic Retirement Planning: While important, planning often concentrated narrowly on accumulating funds for retirement, with less emphasis on holistic tax implications, estate planning, or evolving life goals.

- Fragmented Advice: Clients often sought advice from different professionals for different needs—a stockbroker for investments, an accountant for taxes, a lawyer for estate planning. These advisors rarely coordinated, leading to potential inefficiencies, missed opportunities, and conflicting strategies.

- Product-Centric Model: Many advisors operated on a commission basis, which could incentivize the sale of particular financial products rather than genuinely optimizing for the client’s best long-term interests.

B. The Emergence of Holistic Financial Planning

As client needs grew more complex and financial markets became more sophisticated, the need for a broader approach became apparent, paving the way for the integrated model seen today.

- Fee-Based Advisory: A shift began from commission-based models to fee-based or fee-only models, aligning the advisor’s interests more closely with the client’s. This fostered trust and encouraged comprehensive advice rather than product pushing.

- Comprehensive Needs Assessment: Advisors began to look beyond just investments, incorporating elements like budgeting, debt management, insurance needs, and education planning into their recommendations.

- Life-Stage Planning: Recognizing that financial needs change over a lifetime, planning began to account for different life stages—early career, family formation, peak earning, pre-retirement, and retirement itself.

- Client-Centric Philosophy: The emphasis moved from “what products can I sell?” to “what are the client’s unique goals, values, and circumstances?” This laid the groundwork for true personalization.

C. The Digital Age and Wealth Management’s Transformation

The rapid advancements in technology, coupled with increasing financial complexity and global interconnectedness, have propelled wealth management into its current sophisticated form.

- Data Analytics and AI: The ability to process vast amounts of financial data and leverage Artificial Intelligence (AI) allows for deeper insights, more precise predictions, and the creation of truly customized strategies that were previously impossible.

- Integrated Platforms: Technology platforms now allow wealth managers to integrate investment portfolios, banking accounts, real estate holdings, and other assets into a single, cohesive view, providing clients with a complete financial picture.

- Robo-Advisors and Hybrid Models: Robo-advisors offer automated, algorithm-driven investment management, making basic wealth management more accessible. This has also led to “hybrid” models, combining automated platforms with human advisory for a balanced approach.

- Global Connectivity: Clients and their assets are increasingly global, requiring wealth managers to navigate international tax laws, currency fluctuations, and diverse investment opportunities across borders.

- Focus on Legacy and Impact Investing: Beyond personal wealth, modern wealth management often incorporates philanthropic giving, family legacy planning, and increasingly, impact investing (aligning investments with social or environmental values).

This evolution highlights a continuous journey towards more personalized, comprehensive, and technologically informed strategies, ultimately designed to serve the client’s unique financial journey.

Core Pillars of Holistic Wealth Management

Modern wealth management is built upon several interconnected pillars, each addressing a critical aspect of an individual’s financial ecosystem. A truly effective wealth manager acts as a strategic partner, orchestrating these elements into a cohesive plan.

A. Comprehensive Financial Planning

At its foundation, wealth management begins with a deep dive into an individual’s current financial situation and future aspirations.

- Goal Setting and Alignment: This involves defining clear, measurable, and realistic financial goals (e.g., early retirement, buying a second home, funding children’s education, starting a business, leaving a philanthropic legacy). The plan is then built backwards from these goals.

- Cash Flow and Budgeting Analysis: Understanding income and expenses is crucial. Wealth managers help clients analyze their cash flow, identify saving opportunities, and create sustainable budgets that support their goals without sacrificing current quality of life.

- Debt Management Strategies: For clients with debt, effective strategies are developed for reduction or optimal utilization, differentiating between “good debt” (e.g., mortgage) and “bad debt” (e.g., high-interest credit card debt).

- Risk Tolerance Assessment: A thorough evaluation of a client’s comfort level with financial risk is paramount. This goes beyond simple questionnaires, delving into psychological factors and real-world reactions to market fluctuations.

- Emergency Fund Planning: Ensuring adequate liquid reserves for unforeseen circumstances is a foundational element, protecting long-term investments from premature withdrawal.

B. Investment Management and Portfolio Optimization

This is often the most visible aspect, focusing on growing assets through strategic investment.

- Asset Allocation: Based on risk tolerance, time horizon, and goals, a diversified portfolio is constructed across various asset classes (e.g., equities, fixed income, real estate, alternatives like private equity or hedge funds).

- Security Selection: Within each asset class, specific investment vehicles are chosen (e.g., individual stocks, ETFs, mutual funds, direct real estate, bonds) that align with the strategy.

- Portfolio Rebalancing: Periodically adjusting the portfolio back to its target asset allocation to manage risk and lock in gains.

- Performance Monitoring and Reporting: Continuously tracking portfolio performance against benchmarks and providing transparent reports to clients.

- Behavioral Coaching: Helping clients avoid emotional investment decisions (e.g., panic selling during downturns, chasing hot trends) that can derail long-term plans.

C. Tax Planning and Efficiency

Optimizing a client’s tax position across investments, income, and estate is a critical value-add.

- Tax-Efficient Investing: Utilizing tax-advantaged accounts (e.g., 401(k)s, IRAs, Roth accounts, 529 plans, ISAs) and strategies (e.g., tax-loss harvesting, asset location) to minimize the tax drag on investment returns.

- Income Tax Optimization: Strategies to reduce current income tax liabilities, relevant for high-net-worth individuals, business owners, or those with complex income streams.

- Capital Gains Tax Management: Planning to minimize taxes on investment gains, especially for those with concentrated positions or significant appreciated assets.

- Estate Tax Planning: Proactive strategies to reduce potential estate taxes, ensuring more wealth is transferred to heirs.

- Philanthropic Tax Strategies: Advising on tax-efficient ways to give to charity, often through donor-advised funds, charitable trusts, or direct stock donations.

D. Estate Planning and Legacy Building

Ensuring wealth is transferred according to a client’s wishes, efficiently and with minimal tax implications.

- Wills and Trusts: Guiding clients in creating or updating wills, living wills, and various types of trusts (e.g., revocable, irrevocable, special needs) to control asset distribution, minimize probate, and protect assets.

- Power of Attorney and Healthcare Directives: Ensuring legal documents are in place for financial and healthcare decisions should a client become incapacitated.

- Beneficiary Designations: Reviewing and updating beneficiary designations on investment accounts, life insurance policies, and retirement plans, which often supersede wills.

- Succession Planning (for Business Owners): For clients with businesses, planning for the smooth transition of ownership and management.

- Philanthropic Planning: Integrating charitable giving into the estate plan to leave a lasting impact and potentially reduce estate taxes.

E. Risk Management and Insurance Planning

Protecting assets and income from unforeseen events is fundamental to wealth preservation.

- Life Insurance: Assessing the need for life insurance (term or permanent) to protect dependents and ensure financial security in the event of an untimely death.

- Disability Insurance: Protecting income in case of illness or injury that prevents work.

- Long-Term Care Insurance: Planning for potential future healthcare costs not covered by traditional health insurance.

- Property & Casualty Insurance: Reviewing coverage for homes, vehicles, and other assets, including umbrella policies for extended liability protection.

- Cybersecurity Risk Mitigation: Advising on best practices for protecting digital financial assets and personal information from cyber threats, given the increasing reliance on online platforms.

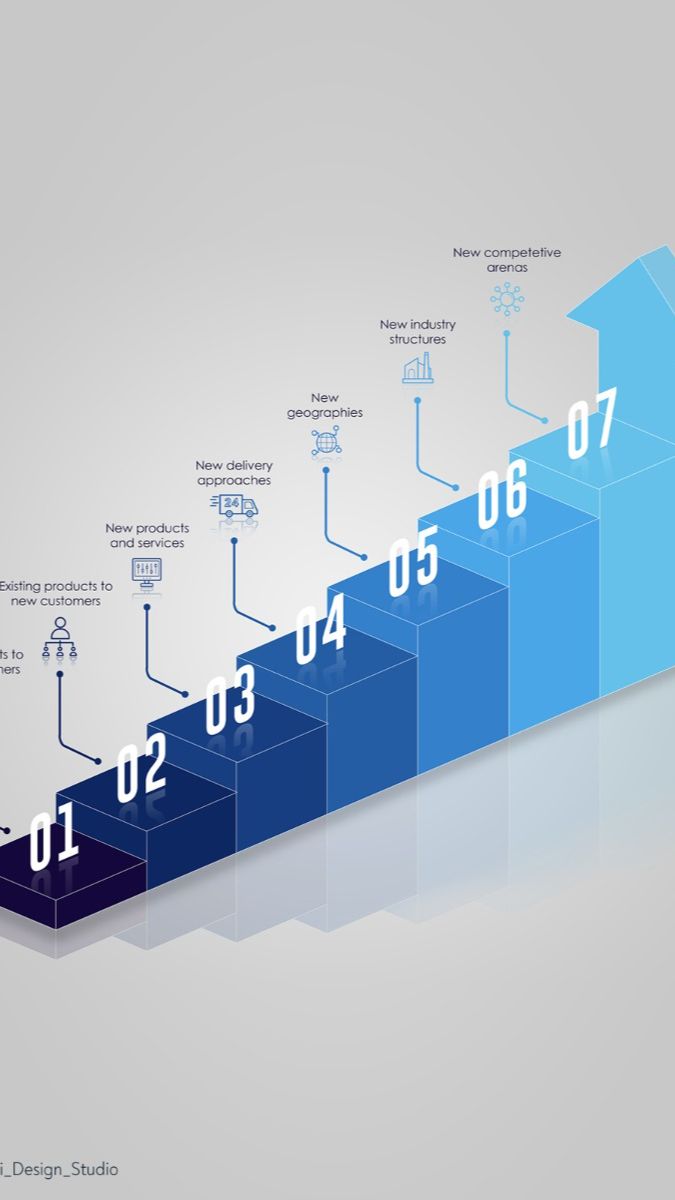

The Personalized Growth Path: Tailoring Strategies for Unique Needs

The essence of modern wealth management lies in its ability to transcend generic advice and craft a truly bespoke financial journey for each client. This personalization is what defines a successful partnership.

A. Deep Client Discovery and Relationship Building

The personalization process begins with an intensive and ongoing client discovery phase that goes far beyond financial statements.

- Life Goals and Values: Understanding not just financial goals but also personal values, family dynamics, health considerations, career aspirations, and philanthropic interests. Is it about early retirement, starting a non-profit, or ensuring generational wealth transfer?

- Current Financial Snapshot: A meticulous collection of all assets (investments, real estate, businesses), liabilities (mortgages, loans), income streams, and expenses.

- Risk Profile Refinement: Beyond simple questionnaires, behavioral finance principles are used to understand true risk tolerance – how a client might react to real market downturns, not just hypothetical ones.

- Communication Preferences: Determining how often and through which channels the client prefers to communicate (e.g., in-person, video calls, email updates, self-service portals).

B. Dynamic Strategy Formulation and Adaptation

Based on the discovery, a dynamic financial strategy is formulated, recognizing that life is not static.

- Integrated Planning: Combining investment, tax, estate, risk management, and philanthropic planning into a single, cohesive strategy where each component supports the others.

- Scenario Planning: Modeling different future scenarios (e.g., market downturns, career changes, unexpected health events) to stress-test the plan and build in resilience.

- Regular Reviews and Adjustments: Financial plans are living documents. Regular, scheduled reviews (e.g., quarterly, semi-annually) ensure the plan remains aligned with evolving life circumstances, market conditions, and tax laws. This adaptation is key to long-term success.

- Goal Reassessment: As clients achieve certain goals or their priorities shift, the plan is recalibrated to reflect these changes.

C. Leveraging Technology for Customization and Insights

Advanced technology is no longer an optional add-on but a fundamental enabler of personalized wealth management.

- AI-Powered Analytics: AI algorithms analyze vast datasets to identify optimal investment strategies tailored to a client’s specific risk profile, liquidity needs, and financial goals, often uncovering patterns human advisors might miss.

- Predictive Modeling: Tools can forecast various financial outcomes based on different investment decisions or life events, helping clients visualize the potential impact of their choices.

- Client Portals and Dashboards: Intuitive digital platforms provide clients with 24/7 access to their consolidated financial data, performance reports, and progress towards goals, fostering transparency and engagement.

- Robo-Advisor Integration (Hybrid Model): For parts of the portfolio that benefit from automated, low-cost management, robo-advisors can be integrated, freeing up human advisors to focus on complex planning, relationship building, and behavioral coaching.

- Personalized Content Delivery: Technology can deliver highly relevant financial education, market insights, and tailored recommendations directly to the client based on their interests and portfolio composition.

D. Specialized Expertise for Niche Needs

True personalization often extends to providing specialized expertise for clients with unique circumstances.

- Business Owners: Advice on succession planning, business valuation, tax strategies for business income, and integrating business and personal finances.

- Executives: Guidance on stock options, restricted stock units (RSUs), concentrated stock positions, and executive compensation strategies.

- Inheritors: Strategies for managing inherited wealth, tax implications, and integrating new assets into an existing financial plan.

- Globally Mobile Clients: Expertise in international tax laws, multi-currency investment strategies, and cross-border estate planning.

- Philanthropists: Structured approaches to charitable giving, including donor-advised funds, private foundations, and impact investing to align wealth with values.

The Broader Impact and Future Trajectory of Wealth Management

Wealth management is not static; it’s a dynamic field continuously adapting to new economic realities, technological innovations, and evolving client demands.

A. Focus on Intergenerational Wealth Transfer and Family Legacy

Modern wealth management is increasingly looking beyond the individual to encompass entire family legacies.

- Multi-Generational Planning: Strategies for transferring wealth efficiently and effectively across generations, including educating heirs on financial literacy and responsibility.

- Family Governance: Assisting families in establishing structures for wealth management decision-making, conflict resolution, and shared values for inherited assets.

- Philanthropic Advising: Guiding families in establishing charitable foundations or trusts to ensure their legacy of giving continues.

- Values-Based Investing: Helping families align their investments with their shared values, particularly in areas like ESG (Environmental, Social, and Governance) or impact investing.

B. Digital Transformation and Enhanced Client Experience

The ongoing digital revolution will continue to reshape the delivery and experience of wealth management.

- Hyper-Personalized Digital Interfaces: AI will create highly intuitive, customized client portals that dynamically adjust to individual needs, displaying relevant information and proactive recommendations.

- Virtual Advisory and Hybrid Models: The blend of human advice with advanced digital tools (hybrid model) will become the norm, offering the best of both worlds: human empathy and strategic insight combined with algorithmic efficiency and scalability.

- Gamification and Behavioral Nudges: Incorporating elements of gamification and behavioral economics to encourage positive financial habits and engagement with the wealth plan.

- Blockchain and Distributed Ledger Technology (DLT): Potential applications in streamlining asset transfers, enhancing security for digital assets, and improving transparency in financial transactions.

C. Regulatory Scrutiny and Ethical AI

As wealth management becomes more data-driven and AI-powered, regulatory bodies will increase their scrutiny.

- Data Privacy and Security: Strict regulations (e.g., GDPR, CCPA) will continue to emphasize data privacy and robust cybersecurity measures to protect sensitive financial information.

- Ethical AI in Finance: Guidelines and regulations will emerge to ensure AI algorithms used in wealth management are fair, transparent, and free from bias, particularly in investment recommendations or risk assessments.

- Fiduciary Duty in a Digital Age: The core principle of acting in the client’s best interest will remain paramount, evolving to address the complexities of AI-driven advice and automated portfolio management.

D. The Rise of Sustainable and Impact Investing (ESG)

A significant and growing trend is the integration of environmental, social, and governance (ESG) factors into investment decisions.

- Client Demand: Increasing demand from clients, particularly younger generations, to align their investments with their personal values and contribute positively to society and the planet.

- Performance Integration: Growing evidence that strong ESG practices can correlate with better long-term financial performance, moving ESG from a niche to a mainstream investment consideration.

- Impact Measurement: Development of more robust methodologies for measuring the real-world impact of investments beyond financial returns.

- Green Finance Products: Proliferation of specialized financial products (e.g., green bonds, sustainable funds) catering to ESG and impact investing mandates.

E. Focus on Financial Literacy and Education

Wealth management is increasingly taking on a role in educating clients, not just advising them.

- Empowering Clients: Providing clients with the tools and knowledge to understand their financial decisions better, fostering greater confidence and engagement.

- Next-Generation Education: Developing engaging digital content, interactive tools, and personalized learning paths to educate younger generations on fundamental financial principles and wealth stewardship.

- Combating Misinformation: Providing reliable, expert-backed financial education in a world saturated with online financial advice, often from unqualified sources.

Conclusion

In an era of relentless change, wealth management stands as a beacon of stability and strategic guidance, empowering individuals and families to navigate their financial journey with confidence and purpose. It has evolved from fragmented, product-centric advice to a highly sophisticated, holistic discipline that crafts personalized growth paths deeply aligned with each client’s unique goals, values, and life circumstances. By seamlessly integrating comprehensive financial planning, astute investment management, proactive tax and estate strategies, and robust risk mitigation, wealth managers act as indispensable partners in securing and enhancing long-term financial well-being.

The future of wealth management will be defined by its continuous embrace of cutting-edge technology, from AI-powered analytics and hyper-personalized digital interfaces to blockchain-enabled efficiencies. Simultaneously, it will deepen its commitment to intergenerational planning, ethical AI, and values-based investing, recognizing that true wealth extends beyond monetary value to encompass legacy and impact. For those seeking to confidently chart their financial future, a personalized wealth management approach is not just an option—it is the essential blueprint for unlocking enduring prosperity and achieving one’s most cherished financial aspirations.