The intricate web of global commerce has become the defining characteristic of our modern era, connecting distant nations through the constant exchange of goods, services, and capital. Understanding these dynamics is no longer reserved for academics or policymakers; it is a vital necessity for anyone looking to navigate the complexities of the current financial landscape.

As borders become more porous for digital data but occasionally more rigid for physical goods, the tension between globalization and regionalism continues to shape the wealth of nations. We are currently witnessing a profound shift in how supply chains are structured, moving from a pure focus on cost-efficiency toward a greater emphasis on resilience and security.

Geopolitical alliances are increasingly dictating trade routes, creating a fragmented yet deeply interdependent world economy. To truly grasp where the global market is headed, one must look deep into the mechanisms of currency fluctuations, trade agreements, and the technological leaps that redefine productivity.

This article provides a comprehensive exploration of the forces driving international trade and how they impact everything from local prices to global stability. By deconstructing the pillars of the international marketplace, we can better anticipate the challenges and opportunities that lie ahead in this hyper-connected age.

The Foundation of Comparative Advantage

International trade is fundamentally built on the principle of comparative advantage, which suggests that nations should specialize in producing what they can make most efficiently. This specialization allows for a higher total global output and lower prices for consumers everywhere.

A. Analyze the resource endowments of a nation to determine its natural strengths.

B. Evaluate the labor productivity rates across different industrial sectors.

C. Identify the opportunity costs involved in choosing one industry over another.

D. Understand how technological expertise creates artificial comparative advantages.

E. Review the impact of infrastructure on the ability to export goods competitively.

When a country focuses on its strengths, it can trade its surplus for goods that are difficult or expensive to produce at home. This creates a win-win scenario where both trading partners increase their standard of living.

However, the reality is often complicated by domestic political pressures to protect struggling industries. Balancing the benefits of free trade with the need for national economic security remains a constant struggle.

Currency Fluctuations and Exchange Rate Mechanics

The value of a nation’s currency is a primary driver of its trade competitiveness on the world stage. A weak currency can make exports cheaper and more attractive, while a strong currency increases the purchasing power of domestic consumers.

A. Monitor the interest rate decisions of major central banks like the Federal Reserve.

B. Assess the impact of trade balances on the demand for specific currencies.

C. Evaluate the role of “safe-haven” currencies during times of global instability.

D. Understand the mechanics of floating versus fixed exchange rate systems.

E. Review how inflation differentials affect the long-term value of a currency.

Exchange rates are essentially the price of one nation’s economic health relative to another’s. They fluctuate based on investor confidence, political stability, and economic data releases.

Businesses engaged in international trade must use complex hedging strategies to protect themselves from sudden currency shifts. A sudden move in the exchange rate can instantly turn a profitable export deal into a significant loss.

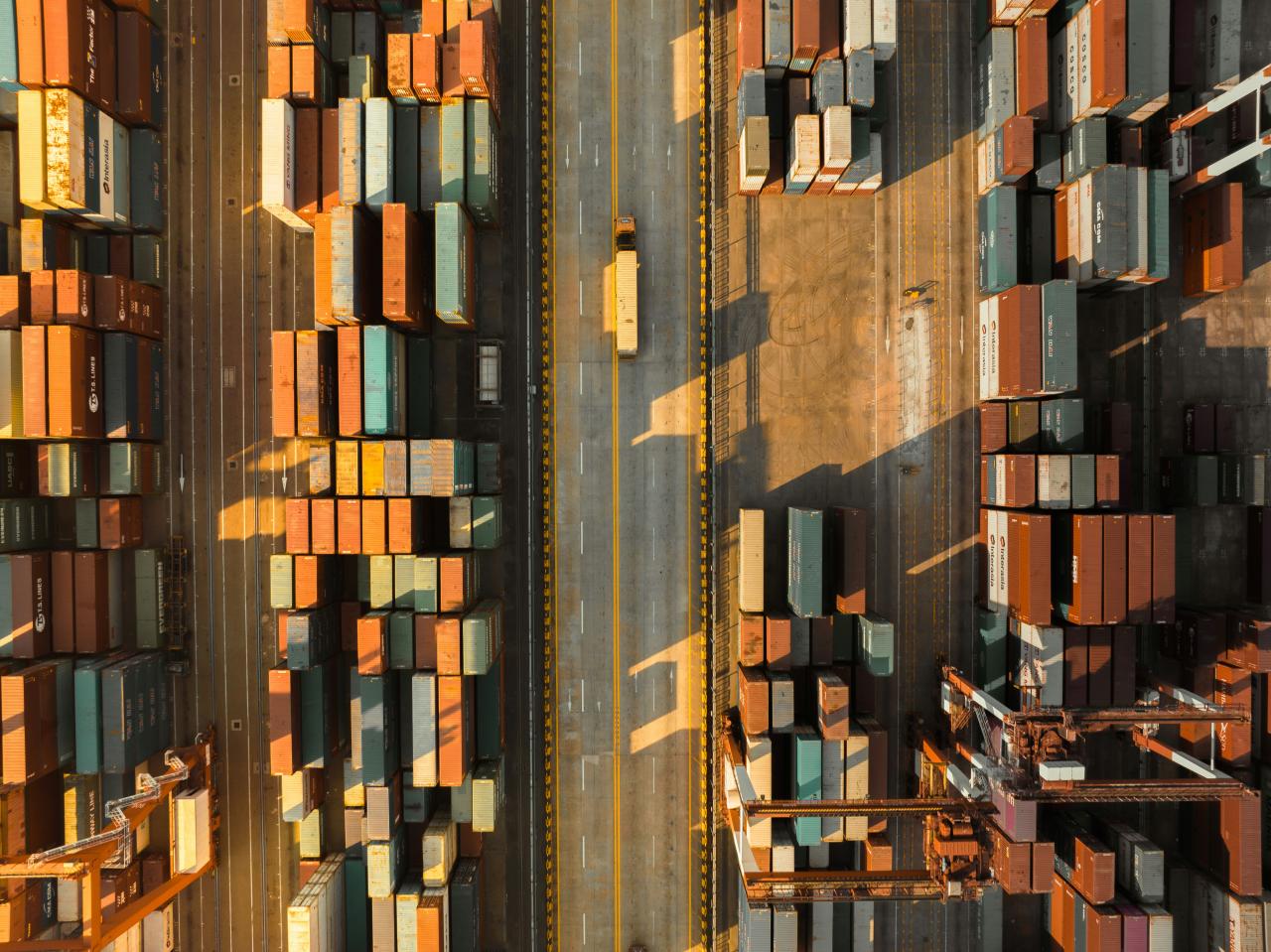

The Evolution of Global Supply Chains

The “just-in-time” manufacturing model that dominated the last few decades is being replaced by a more cautious “just-in-case” approach. Resilience has become the new watchword for multinational corporations managing global logistics.

A. Map out the geographical distribution of key component suppliers.

B. Identify single points of failure within a global manufacturing network.

C. Evaluate the benefits of “near-shoring” production closer to the end consumer.

D. Analyze the impact of transportation costs and shipping delays on inventory.

E. Review the role of digital twins in simulating supply chain disruptions.Shutterstock

The world has learned that over-reliance on a single region for critical components is a dangerous strategy. Diversification of supply sources is now seen as a matter of national and corporate survival.

Automation and robotics are also making it more feasible to bring manufacturing back to high-cost labor markets. This “re-shoring” trend is slowly reshaping the industrial heartlands of many developed nations.

Trade Agreements and Regional Blocs

Trade is rarely completely free; it is governed by a complex layer of bilateral and multilateral agreements. These treaties define the rules of engagement, from tariff rates to intellectual property protections.

A. Analyze the impact of the World Trade Organization (WTO) on global standards.

B. Evaluate the growth of regional blocs like the European Union or USMCA.

C. Identify the role of “Rules of Origin” in determining tariff eligibility.

D. Understand the dispute settlement mechanisms used to resolve trade conflicts.

E. Review the inclusion of environmental and labor standards in modern treaties.

Regional trade blocs create a “fortress” effect that encourages trade within the group while sometimes penalizing those outside it. This can lead to trade diversion, where a more efficient global producer is replaced by a less efficient regional one.

Negotiating these deals takes years of diplomatic effort and often involves significant domestic compromise. Every tariff reduced in one sector usually requires a concession in another, making trade policy a high-stakes game.

The Impact of Trade Barriers and Protectionism

While free trade is generally favored by economists, many governments use barriers to protect local jobs or strategic industries. These tools can take many forms, from direct taxes to subtle regulatory hurdles.

A. Categorize tariffs as either ad valorem or specific duties.

B. Identify non-tariff barriers such as quotas, licenses, and technical standards.

C. Evaluate the use of subsidies to give domestic firms an unfair advantage.

D. Analyze the effectiveness of anti-dumping duties against predatory pricing.

E. Review the “infant industry” argument for temporary protection.

Protectionism often leads to retaliatory measures, sparking trade wars that can damage the entire global economy. Consumers usually pay the ultimate price through higher costs and reduced choice.

In the short term, trade barriers may save specific jobs, but in the long term, they often lead to inefficiency. Protected industries have less incentive to innovate or improve their productivity compared to global competitors.

The Digitalization of International Services

Trade is no longer just about shipping containers filled with physical goods; the service sector is the fastest-growing component of global commerce. Software, consulting, and entertainment are now traded instantly across borders.

A. Monitor the growth of cross-border e-commerce and digital platforms.

B. Evaluate the role of cloud computing in enabling remote global teams.

C. Identify the challenges of taxing digital services in a globalized world.

D. Understand the impact of data localization laws on international business.

E. Review the rise of “micro-multinationals” that operate globally from day one.

Digital trade has lowered the barrier to entry for small businesses looking to go international. An independent developer in Indonesia can now sell their app to a customer in Brazil with minimal friction.

However, this digital shift also creates new challenges regarding privacy and cybersecurity. Governments are struggling to keep up with the regulatory requirements of an economy that moves at the speed of light.

Commodity Markets and the Global Energy Trade

Raw materials and energy are the lifeblood of the global economy, and their trade dynamics are deeply tied to geopolitical power. Shifts in the price of oil, gas, or rare earth minerals can cause ripples across every other sector.

A. Analyze the influence of OPEC+ on global oil supply and pricing.

B. Evaluate the strategic importance of rare earth minerals for green tech.

C. Identify the impact of commodity price volatility on emerging economies.

D. Understand the shift toward Liquefied Natural Gas (LNG) as a global bridge fuel.

E. Review the role of commodity futures markets in discovery and hedging.

Nations that possess critical resources often use them as a tool of foreign policy, leading to “energy diplomacy.” Conversely, resource-poor nations must build complex alliances to ensure their energy security.

The transition to renewable energy is creating a new map of resource dependency. Copper, lithium, and cobalt are becoming the “new oil,” shifting the focus of international trade toward mining and battery tech.

The Role of Foreign Direct Investment (FDI)

Trade and investment are two sides of the same coin. When a company builds a factory in a foreign country, it creates a long-term economic link that goes beyond simple buying and selling.

A. Distinguish between greenfield investments and cross-border acquisitions.

B. Evaluate the factors that make a country an attractive destination for FDI.

C. Identify the role of Special Economic Zones (SEZs) in attracting capital.

D. Analyze the “knowledge spillover” effect where local firms learn from foreign ones.

E. Review the risks of capital flight and sudden investment reversals.

FDI is a major driver of development in emerging markets, providing much-needed capital and technology. It creates jobs and integrates local businesses into global value chains.

However, host countries must be careful to ensure that FDI benefits the local economy rather than just extracting wealth. Strong legal frameworks and infrastructure are essential for a successful long-term investment relationship.

The Influence of Multinational Corporations (MNCs)

A few hundred massive companies now control a significant portion of all global trade. These MNCs operate across dozens of jurisdictions, making them more powerful than many small nation-states.

A. Analyze the use of transfer pricing to move profits to low-tax jurisdictions.

B. Evaluate the impact of MNCs on local labor markets and environmental standards.

C. Identify the role of global branding in creating consumer demand across cultures.

D. Understand the complexity of managing a diverse, international workforce.

E. Review the legal challenges of holding MNCs accountable for their global actions.

MNCs bring efficiency and innovation to the global market, but they also raise concerns about corporate sovereignty. Their ability to move capital quickly gives them significant leverage over national governments.

The modern MNC is less a single company and more a coordinator of a vast, global network of suppliers and partners. Managing this network requires incredible logistical expertise and cultural sensitivity.

International Finance and the Balance of Payments

A nation’s relationship with the rest of the world is summarized in its Balance of Payments (BoP). This record tracks every transaction, from trade in goods to the purchase of foreign stocks and bonds.

A. Distinguish between the Current Account and the Capital Account.

B. Analyze the causes and consequences of chronic trade deficits.

C. Evaluate the role of foreign exchange reserves in maintaining BoP stability.

&D. Understand how a nation’s debt levels affect its international standing.

E. Review the impact of sudden “capital stops” on developing economies.

A persistent trade deficit means a country is essentially living beyond its means, relying on foreign capital to fill the gap. While this can work for a while, it eventually leads to a buildup of external debt.

Central banks use their reserves to intervene in the market and stabilize their currency if the BoP falls out of balance. This is why having a large “war chest” of foreign currency is so important for economic stability.

Emerging Markets and the Shift in Economic Gravity

The dominance of Western economies is being challenged by the rapid rise of emerging markets, particularly in Asia. This shift is changing the flow of global trade and the nature of consumer demand.

A. Monitor the growth of the middle class in nations like India and Indonesia.

B. Evaluate the role of the BRICS+ nations in creating an alternative economic bloc.

C. Identify the impact of South-South trade on traditional trade routes.

D. Understand the challenges of doing business in markets with evolving legal systems.

E. Review the infrastructure investments of the “Belt and Road Initiative.”

As emerging markets grow, they are becoming the primary drivers of global demand for everything from smartphones to luxury cars. This is forcing global brands to adapt their products to suit non-Western tastes and cultures.

The rise of these new powers is also leading to the creation of new financial institutions that compete with the IMF and World Bank. This is making the global financial architecture more multi-polar and complex.

Technology as a Disruptor of Trade Logistics

The physical act of moving goods is being revolutionized by automation, blockchain, and AI. These technologies are reducing the “friction” of trade, making it cheaper and faster than ever before.

A. Analyze the impact of blockchain on reducing trade documentation fraud.

B. Evaluate the role of AI in optimizing cargo routes and fuel consumption.

C. Identify the potential of autonomous ships and trucks in global logistics.

D. Understand how 3D printing could replace the trade of physical goods with digital files.

E. Review the use of IoT sensors to track the condition of perishable goods.

Blockchain provides a “single source of truth” for all parties in a trade deal, from the exporter to the bank and the customs office. This eliminates the need for massive piles of paper and reduces the time spent in port.

In the future, we may not ship a plastic toy from China; we might just buy the digital file and print it at home. This “dematerialization” of trade could have profound impacts on global shipping volumes.

The Geopolitics of Trade Wars and Sanctions

Trade is increasingly being used as a weapon in international diplomacy. Economic sanctions and export controls are now the first line of defense in modern conflict.

A. Analyze the effectiveness of sanctions in achieving political goals.

B. Evaluate the impact of export controls on high-tech components like semiconductors.

C. Identify the risks of “weaponizing” interdependence in global supply chains.

D. Understand the role of “friend-shoring” in building resilient, allied trade networks.

E. Review the legal frameworks that govern the use of economic statecraft.

When one country limits another’s access to critical technology, it forces that nation to develop its own domestic capabilities. This can lead to a “decoupling” of major economies, creating separate and incompatible tech ecosystems.

Sanctions often have unintended side effects, hurting innocent civilians and damaging the global financial system’s reputation for neutrality. Balancing political pressure with economic stability is a delicate act for any leader.

Sustainability and the Future of Ethical Trade

Consumers and regulators are increasingly demanding that international trade be conducted in a way that respects the environment and human rights. “Green trade” is becoming a mandatory standard.

A. Monitor the implementation of Carbon Border Adjustment Mechanisms (CBAM).

B. Evaluate the role of fair trade certifications in improving labor conditions.

C. Identify the challenges of tracking environmental impacts across deep supply chains.

D. Understand the shift toward circular economies that reduce the need for raw material imports.

E. Review the impact of ESG (Environmental, Social, and Governance) scores on trade finance.

Companies are now being held responsible for what happens five levels deep in their supply chain. This is forcing them to adopt better tracking technology and more rigorous auditing processes.

The “green transition” is also creating new trade opportunities in environmental services and clean tech. Nations that lead in these sectors will likely be the dominant economic powers of the next century.

Conclusion

Navigating the world of global trade requires a deep understanding of many moving parts. The economic success of a nation is now inextricably linked to its international relationships. You must stay informed about currency trends to protect your own financial interests.

Globalization is not disappearing, but it is certainly changing its fundamental shape. Technological innovation continues to be the primary driver of market efficiency and growth. Understanding trade agreements can help you spot the next big investment opportunity. Resilience has replaced cost as the most important factor in supply chain management.

The rise of emerging markets is creating a more balanced and diverse global economy. Digital trade is opening doors for small businesses that were once closed to them. Ethical and sustainable practices are no longer optional in the world of high-level commerce. Geopolitics will always play a role in how goods and services move across borders. By staying curious and analytical, you can thrive in this complex international marketplace.