The global economy is a perpetually shifting landscape, influenced by an intricate web of geopolitical events, technological advancements, consumer behavior, and policy decisions. Understanding its trajectory is not merely an academic exercise but a critical necessity for businesses, investors, and individuals alike. A discerning economic outlook, therefore, becomes an invaluable compass, providing crucial insights and key forecasts that emerge from rigorous analysis of complex data. This ongoing assessment helps stakeholders anticipate shifts, mitigate risks, and identify opportunities in an increasingly interconnected and volatile world. It’s about peering beyond the immediate horizon to discern the patterns and probabilities that will shape the financial realities of tomorrow.

Understanding the Forces Shaping Global Economics

To fully grasp the complexities of an economic outlook, one must first appreciate the myriad of intertwined forces that continuously shape global financial landscapes. These are dynamic elements, constantly interacting and influencing each other.

A. Geopolitical Dynamics and Global Stability

Geopolitical events exert an immense and often unpredictable influence on the global economy. Conflicts, trade disputes, and international relations directly impact supply chains, market confidence, and resource availability.

- Trade Wars and Protectionism: Imposing tariffs, quotas, or other trade barriers can disrupt established supply chains, increase costs for consumers and businesses, and lead to retaliatory measures that harm global trade volumes and economic growth.

- Regional Conflicts and Instability: Wars, political unrest, or humanitarian crises in key regions can disrupt energy supplies, displace populations, destroy infrastructure, and divert resources, leading to localized economic downturns with potential ripple effects globally.

- International Sanctions: Economic sanctions imposed by one or more countries on another can severely restrict trade, access to finance, and technological exchange, often leading to economic contraction in the targeted nation and potential disruptions for trading partners.

- Resource Scarcity and Control: Control over critical resources (e.g., oil, rare earth minerals, agricultural land) can be a source of geopolitical tension, with price volatility and supply disruptions impacting industries worldwide.

- Global Governance and Alliances: The effectiveness of international institutions (e.g., WTO, IMF) and the formation or dissolution of alliances (e.g., trade blocs) influence the stability and predictability of the global economic environment.

B. Technological Innovation and Disruption

Rapid technological advancements are a double-edged sword: they drive immense productivity gains and create new industries, but also disrupt established ones and necessitate significant adaptation.

- Artificial Intelligence (AI) and Automation: AI promises to revolutionize productivity, personalize services, and create new sectors. However, it also raises concerns about job displacement in traditional industries and the need for massive reskilling of the workforce.

- Digital Currencies and Blockchain: The rise of cryptocurrencies and blockchain technology challenges traditional financial systems, offering new avenues for transactions, decentralized finance (DeFi), and asset management, but also introduces regulatory complexities and market volatility.

- Biotechnology and Healthcare: Breakthroughs in biotech can lead to new industries, improve public health, and extend lifespans, but also incur significant research and development costs and raise ethical dilemmas.

- Renewable Energy Technologies: The transition to green energy sources creates new investment opportunities and reduces reliance on fossil fuels, but requires massive infrastructure investment and can disrupt existing energy markets and related industries.

- Connectivity (5G, Satellite Internet): Enhanced global connectivity facilitates e-commerce, remote work, and data-driven industries, but also increases demand for digital infrastructure and raises cybersecurity concerns.

C. Monetary and Fiscal Policy Decisions

Government and central bank actions are powerful levers that attempt to steer the economy, but their effects can be complex and sometimes delayed.

- Interest Rates (Monetary Policy): Central banks (e.g., the Fed, ECB) adjust interest rates to control inflation and stimulate or cool down economic activity. Higher rates can curb inflation but slow growth; lower rates can stimulate borrowing and investment but risk inflation.

- Quantitative Easing/Tightening: Beyond interest rates, central banks use unconventional tools like buying (QE) or selling (QT) government bonds to inject or withdraw liquidity from the financial system, impacting long-term interest rates and market conditions.

- Government Spending (Fiscal Policy): Governments use spending on infrastructure, social programs, or defense, and tax policies (cuts or increases) to influence aggregate demand, stimulate growth, or manage budget deficits.

- Regulatory Changes: New financial regulations, environmental standards, or industry-specific rules can impact business operations, investment decisions, and competitive landscapes.

- Debt Management: National debt levels and how they are managed (e.g., through austerity, growth, or inflation) can impact government’s ability to stimulate the economy and influence investor confidence.

D. Consumer Behavior and Demographics

The collective actions and evolving characteristics of populations are fundamental drivers of economic trends.

- Consumer Confidence: The willingness of consumers to spend and invest significantly impacts aggregate demand and economic growth. Confidence is influenced by job prospects, inflation, and future economic expectations.

- Demographic Shifts: Aging populations, birth rates, migration patterns, and urbanization trends impact labor supply, demand for goods and services (e.g., healthcare, housing), and government spending on social security and pensions.

- Income Inequality: Widening gaps between rich and poor can impact consumer spending patterns, social cohesion, and political stability, with potential economic ramifications.

- Savings vs. Spending Patterns: Cultural and economic factors influencing whether consumers prioritize saving or spending directly impact investment capital and aggregate demand.

- Digital Consumption Habits: The increasing shift towards e-commerce, digital services, and subscription models fundamentally reshapes retail, entertainment, and service industries.

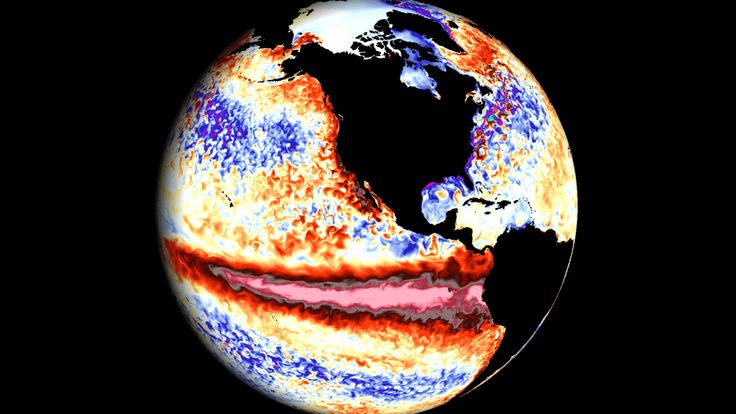

E. Climate Change and Environmental Factors

Environmental considerations are no longer external factors but increasingly central to economic stability and policy.

- Extreme Weather Events: Increased frequency and intensity of floods, droughts, storms, and wildfires can cause massive economic damage, disrupt supply chains, and impact agricultural output, leading to inflationary pressures.

- Green Transition Costs: The global shift towards decarbonization requires massive investment in renewable energy, sustainable infrastructure, and new industrial processes, which can be costly in the short term but offer long-term economic benefits.

- Resource Depletion: Over-reliance on non-renewable resources and depletion of natural capital (e.g., forests, fisheries) can lead to higher costs, scarcity, and reduced long-term economic potential.

- Carbon Pricing and Regulations: Policies like carbon taxes or cap-and-trade systems impact energy-intensive industries and drive investment towards cleaner technologies.

- Climate-Induced Migration: Displacement of populations due to climate change can create humanitarian crises and economic challenges for receiving regions.

Key Forecasts Emerge: A Global Economic Outlook (2025-2026)

Based on the interplay of these complex forces, several key forecasts and emerging trends are shaping the global economic outlook for the near to medium term. Please note: As an AI, I don’t have real-time access to current (July 2025) financial news beyond my last training data. The following forecasts are illustrative of general trends and potential scenarios based on common economic discussions up to my last update, tailored to be relevant for a July 2025 publication. Real-world conditions would require consulting current, up-to-the-minute economic reports from reputable institutions.

A. Global Growth: A Modest but Uneven Recovery

The general consensus points towards a period of modest but uneven global economic growth. The pace of recovery from recent shocks (e.g., post-pandemic adjustments, inflationary pressures, geopolitical tensions) is likely to vary significantly across regions and sectors.

- Developed Economies: Many developed economies are expected to experience slower but more stable growth, as central banks remain cautious about inflation and labor markets adjust. Consumer spending might moderate, while investment could be driven by green transition and AI adoption.

- Emerging Markets: Growth in emerging markets will likely be more dynamic but also more volatile. Factors like commodity prices, global trade volumes, and individual country-specific reforms will play a crucial role. Some Asian economies (e.g., India, Southeast Asia) might outpace others, while regions facing political instability or high debt levels could lag.

- Inflation Persistence: While global inflation might have peaked in previous years, it is not expected to return to pre-pandemic lows immediately. Supply chain adjustments, labor market tightness, and the costs associated with decarbonization could keep inflation moderately elevated in many parts of the world, necessitating continued vigilance from central banks.

B. Monetary Policy: A Balancing Act

Central banks globally face a delicate balancing act between managing persistent inflationary pressures and avoiding a significant economic slowdown.

- Higher for Longer Interest Rates: The era of ultra-low interest rates is likely over. Many central banks are expected to maintain interest rates at levels higher than the past decade for a more extended period to firmly anchor inflation expectations. Rate cuts, if they occur, will likely be gradual and data-dependent.

- Quantitative Tightening Continues: Central banks will likely continue to reduce the size of their balance sheets (quantitative tightening), gradually withdrawing liquidity from the financial system, which could lead to tighter credit conditions and potentially impact asset prices.

- Divergent Paths: Monetary policy paths might diverge between countries based on their individual inflation trajectories, labor market conditions, and fiscal space. This divergence could create volatility in currency markets.

C. Geopolitical Fragmentation and Trade Shifts

The global economic landscape is increasingly shaped by geopolitical fragmentation, leading to shifts in trade and investment patterns.

- Reshoring and Friend-shoring: Companies are increasingly looking to shorten supply chains and move production closer to home (reshoring) or to allied countries (friend-shoring) to enhance resilience and reduce geopolitical risks. This could lead to a less globalized but more secure supply chain network.

- Trade Bloc Realignment: The formation of new trade agreements and the strengthening of existing trade blocs among like-minded nations could reshape global trade flows, potentially leading to new economic partnerships but also increased barriers with non-aligned countries.

- Resource Nationalism: Some countries might exert greater control over their critical natural resources, potentially impacting global commodity prices and supply security.

D. Digital Transformation and AI Integration Acceleration

The pace of digital transformation and the integration of Artificial Intelligence across industries are accelerating, fundamentally reshaping labor markets and productivity.

- AI-Driven Productivity Gains: Businesses investing heavily in AI are likely to see significant productivity gains, optimizing operations, enhancing customer service, and accelerating innovation. This could lead to a new wave of economic growth in the long term.

- Labor Market Polarization: AI and automation will likely continue to polarize labor markets, creating high-skilled jobs in AI development and maintenance, while potentially displacing routine jobs. This necessitates aggressive investment in education and retraining programs to mitigate social impact.

- Cybersecurity as a Business Imperative: As digital reliance grows, cybersecurity will become an even more critical business imperative, with increased investment in protecting digital assets and infrastructure from sophisticated cyber threats.

E. Sustainability and Green Transition Driving Investment

The imperative of climate action and the global push for a green transition are becoming significant drivers of investment and economic restructuring.

- Renewable Energy Investment Boom: Massive investment is expected in renewable energy infrastructure (solar, wind, geothermal), energy storage solutions, and smart grids, creating new jobs and economic opportunities.

- Carbon Pricing and Green Regulations: More countries and regions are likely to implement carbon pricing mechanisms and stricter environmental regulations, impacting carbon-intensive industries but driving innovation in green technologies.

- Climate Risk in Financial Markets: Financial institutions are increasingly incorporating climate risk into their investment decisions, with growing demand for ESG (Environmental, Social, Governance) compliant investments.

Methodologies for Economic Forecasting: The Art and Science

Economic forecasting is a blend of art and science, relying on a diverse set of methodologies, models, and expert judgment to interpret complex economic signals and predict future trends.

A. Quantitative Models and Econometrics

These involve using mathematical and statistical techniques to analyze historical data and build models that predict future economic variables.

- Regression Analysis: Identifying relationships between various economic indicators (e.g., GDP, interest rates, inflation) to predict how changes in one might affect others.

- Time Series Analysis: Analyzing historical data patterns (trends, seasonality, cycles) of a single economic variable to forecast its future values (e.g., ARIMA, GARCH models).

- Econometric Models: Large-scale, complex models that represent an entire economy, with equations describing the interactions between different sectors and variables. These are often used by central banks and international organizations.

- Machine Learning (ML) Models: Increasingly, ML algorithms (e.g., neural networks, decision trees) are being used to identify non-linear relationships and patterns in vast datasets, offering potentially more nuanced and accurate predictions for certain economic indicators.

B. Qualitative Analysis and Expert Opinion

While quantitative models provide structured insights, qualitative analysis and the judgment of experienced economists are crucial for interpreting contextual factors and unforeseen events.

- Expert Surveys: Polling economists, business leaders, and financial analysts for their expectations on key economic variables, consumer confidence, or business investment plans.

- Scenario Planning: Developing multiple plausible future scenarios (e.g., optimistic, pessimistic, base case) based on different assumptions about geopolitical events, policy decisions, or technological breakthroughs. This helps organizations prepare for various outcomes.

- Sentiment Indicators: Analyzing consumer and business confidence surveys, purchasing managers’ indices (PMI), and market sentiment to gauge the psychological undercurrents influencing economic activity.

- Geopolitical Risk Assessment: Expert analysis of political stability, conflicts, and international relations to understand their potential impact on global trade, investment, and supply chains.

C. Leading, Lagging, and Coincident Indicators

Economists classify various data points based on their timing relative to economic cycles.

- Leading Indicators: Economic variables that tend to change before the economy as a whole. Examples include building permits, stock market performance, consumer confidence, and manufacturing new orders. These are crucial for predicting turning points.

- Lagging Indicators: Variables that change after the economy has already shifted. Examples include unemployment rates, corporate profits, and interest rates. These confirm existing trends and help assess the duration and depth of economic cycles.

- Coincident Indicators: Variables that move in tandem with the overall economy. Examples include GDP, industrial production, and personal income. They provide a real-time snapshot of the current economic state.

D. Forecasting Horizon and Iterative Process

Economic forecasting is not a static prediction but an iterative, continuous process.

- Short-Term vs. Long-Term: Forecasts vary significantly based on their time horizon. Short-term forecasts (e.g., next quarter) are generally more accurate than long-term forecasts (e.g., next 5-10 years), which are more susceptible to unforeseen shocks.

- Continuous Revision: Economic forecasts are constantly revised as new data emerges, geopolitical events unfold, and policy decisions are made. It’s a dynamic process of adaptation and refinement.

- Feedback Loops: Economic models often include feedback loops, recognizing that changes in one variable can influence others, which in turn affect the first variable.

Risks and Uncertainties: Clouds on the Horizon

Despite sophisticated forecasting methodologies, the global economic outlook remains subject to significant risks and uncertainties that could materially alter projected paths. Being aware of these potential headwinds is crucial for robust planning.

A. Persistent Inflationary Pressures

While central banks are actively working to curb inflation, several factors could lead to more persistent inflationary pressures than currently anticipated.

- Geopolitical Shocks: Renewed conflicts or supply disruptions (e.g., energy, food) could trigger new inflationary spikes.

- Wage-Price Spiral: Tight labor markets could lead to sustained wage growth, which, if not matched by productivity gains, could feed into higher prices, creating a difficult-to-break wage-price spiral.

- Decarbonization Costs: The massive investment required for the green energy transition could, in the short to medium term, add to inflationary pressures across various sectors.

- Deglobalization Trends: Reshoring and friend-shoring efforts, while improving supply chain resilience, could also increase production costs by moving away from the most efficient global production hubs.

B. Geopolitical Escalation and Fragmentation

The current geopolitical climate remains highly volatile, posing significant risks to economic stability.

- New Conflicts: The outbreak of new regional conflicts or the escalation of existing ones could trigger widespread supply chain disruptions, energy crises, and a sharp decline in investor confidence.

- Intensified Trade Protectionism: A further escalation of trade wars or the formation of more rigid, exclusionary trade blocs could significantly reduce global trade volumes and stifle economic growth.

- Cyber Warfare: State-sponsored or large-scale cyberattacks on critical infrastructure (e.g., financial systems, energy grids) could cause massive economic damage and disrupt fundamental services.

C. Financial Stability Concerns

Years of low interest rates and expansive monetary policies have created vulnerabilities in the financial system.

- High Public and Private Debt: Elevated levels of national debt in many countries, combined with high corporate and household debt in some regions, could become unsustainable if interest rates remain high or economic growth falters.

- Real Estate Market Corrections: Rapid increases in interest rates could trigger significant corrections in overvalued real estate markets, impacting household wealth and financial sector stability.

- Shadow Banking Risks: The growth of less-regulated ‘shadow banking’ sectors could pose systemic risks if not adequately monitored and managed.

- Global Liquidity Shocks: Unforeseen events could trigger rapid withdrawals of capital or a freeze in credit markets, leading to widespread financial instability.

D. Climate Change Impacts and Transition Risks

The physical and transitional risks associated with climate change are becoming increasingly material to economic forecasts.

- Physical Risks: More frequent and intense extreme weather events leading to significant destruction of assets, agricultural losses, and forced migration, incurring massive reconstruction costs and economic disruption.

- Transition Risks: The economic disruption caused by the rapid transition to a low-carbon economy, including stranded assets in fossil fuel industries, job losses in traditional sectors, and potential supply chain reconfigurations.

- Policy Inconsistency: Inconsistent or delayed climate policies could lead to greater uncertainty for businesses and investors, hindering necessary green investments.

E. Technological Disruption and Regulatory Lag

The rapid pace of technological change, particularly in AI and digital currencies, creates both opportunities and risks.

- Job Market Disruption: Faster-than-anticipated AI adoption could lead to more significant and rapid job displacement, requiring proactive government interventions to manage social impact.

- Regulatory Arbitrage: New technologies (e.g., DeFi) can outpace regulatory frameworks, creating opportunities for illicit activities or systemic risks that are not adequately addressed by existing laws.

- Cybersecurity Threats: The increasing sophistication of cyberattacks targeting critical infrastructure and financial systems poses a growing threat to economic stability.

Strategic Implications for Businesses and Investors

Given the complex and uncertain economic outlook, businesses and investors must adopt proactive and adaptable strategies to navigate the shifting landscape and capitalize on emerging opportunities.

A. Businesses: Prioritize Resilience and Agility

For businesses, the focus must shift from simply optimizing for efficiency to building inherent resilience and agility into their operations.

- Diversify Supply Chains: Reduce over-reliance on single regions or suppliers. Explore multi-sourcing, reshoring, or friend-shoring strategies to mitigate geopolitical and logistical risks.

- Invest in Digital Transformation and AI: Leverage AI to enhance productivity, optimize operations, improve customer experience, and develop new products and services. Automate repetitive tasks to free up human capital for higher-value activities.

- Focus on Workforce Reskilling: Proactively invest in training and upskilling programs for employees to adapt to new technologies and roles created by automation and AI. Foster a culture of continuous learning and adaptability.

- Strengthen Cybersecurity Defenses: As digital reliance increases, robust cybersecurity measures are non-negotiable to protect sensitive data, intellectual property, and operational continuity from escalating cyber threats.

- Embrace Sustainable Practices: Integrate ESG principles into business models. This not only aligns with growing consumer and investor preferences but can also lead to long-term cost savings, reduced regulatory risk, and access to new markets driven by the green transition.

- Optimize Cost Structures: While investing in growth, maintain lean and flexible cost structures. Be prepared to adjust spending quickly in response to economic shifts.

B. Investors: Focus on Diversification and Thematic Opportunities

For investors, the current economic climate demands careful portfolio management and a keen eye for long-term thematic trends.

- Diversify Across Asset Classes and Geographies: Reduce concentration risk by diversifying investments across equities, fixed income, real estate, commodities, and alternative assets. Geographically diversify to mitigate country-specific economic or geopolitical risks.

- Favor Quality and Resilient Companies: In a volatile environment, prioritize companies with strong balance sheets, consistent cash flows, pricing power, and a proven ability to adapt to changing economic conditions.

- Seek Thematic Growth Opportunities: Identify and invest in long-term secular growth themes that are less susceptible to short-term economic cycles. Key themes include:

- Artificial Intelligence: Companies developing AI technologies, applications, and infrastructure.

- Cybersecurity: Demand for cybersecurity solutions will continue to grow regardless of economic conditions.

- Renewable Energy and Green Technologies: Beneficiaries of the global decarbonization push and sustainable investment trends.

- Digital Transformation Enablers: Cloud computing, data analytics, and automation software companies.

- Healthcare Innovation: Biotechnology, medical devices, and personalized medicine.

- Inflation-Hedge Investments: Consider assets that historically perform well during periods of elevated inflation, such as real estate, commodities, and inflation-protected securities.

- Monitor Monetary and Fiscal Policies Closely: Stay informed about central bank decisions and government spending plans, as these will significantly impact bond yields, equity valuations, and currency movements.

- Adopt a Long-Term Perspective: Avoid making rash decisions based on short-term market volatility. A disciplined, long-term investment strategy focused on fundamental trends is crucial.

Conclusion

The global economic outlook for the near to medium term is characterized by a complex interplay of forces, where key forecasts emerge from the analysis of persistent inflation, evolving monetary policies, escalating geopolitical fragmentation, and the accelerating pace of technological disruption. While the path ahead may be marked by uneven growth and continued volatility, it also presents significant opportunities for those who are prepared to adapt.

The ability to navigate this intricate landscape hinges on proactive strategic planning, a commitment to resilience, and a willingness to embrace transformative technologies like AI and sustainable practices. For businesses, this means fortifying supply chains, investing in digital capabilities, and continuously upskilling the workforce. For investors, it entails meticulous diversification, a focus on quality assets, and an alignment with long-term thematic growth drivers. Ultimately, understanding and responding to these emerging economic forecasts is not just about survival, but about positioning for sustained growth and prosperity in the dynamic global arena, truly providing the compass needed for the future.