The financial world is evolving rapidly, and one of the most significant shifts in recent years is the rise of ethical investing. For decades, investment decisions were based almost entirely on numbers: profit margins, growth rates, and market potential.

But today, the landscape looks very different. Investors are increasingly asking questions that go beyond balance sheets: Does this company respect the environment? Does it treat its workers fairly? Does it operate transparently?

This change has given birth to ethical investing, a movement where profit is combined with purpose.

Ethical investing is no longer a niche strategy reserved for idealists—it is now a powerful mainstream trend that is shaping markets globally.

This article dives into the meaning, history, benefits, challenges, and strategies of ethical investing, while exploring why it matters more than ever in our interconnected world.

Understanding Ethical Investing

Ethical investing is the practice of aligning financial choices with personal or institutional values. Unlike traditional investing, which focuses solely on returns, ethical investing considers the wider impact of money.

A. Defining Ethical Investment

At its core, ethical investing means channeling funds into companies or industries that support environmental sustainability, human rights, and corporate responsibility. This can include clean energy providers, companies promoting diversity, or firms committed to fair wages.

B. Scope and Flexibility

The scope is broad. Some investors avoid harmful industries like tobacco, gambling, or weapons, while others actively choose businesses leading in renewable energy, social innovation, or technological solutions for climate change.

C. Merging Profit with Principles

The essence of ethical investing is balance. Investors are not abandoning profit—they are redefining it to include positive social and environmental outcomes.

Historical Roots of Ethical Investing

Though ethical investing feels like a modern idea, its origins stretch back centuries. People have long considered morality in financial decisions.

A. Religious Foundations

Many faith groups historically restricted investments in businesses considered sinful. For example, Quakers in the 18th century refused to invest in slavery, alcohol, or weapons. Similarly, Islamic finance principles forbid interest-based lending and industries deemed harmful.

B. Social Movements and Activism

During the 20th century, ethical investing gained visibility through activism. In the 1970s and 1980s, global campaigns encouraged divestment from companies linked to apartheid South Africa, highlighting how money could drive social change.

C. Modern Evolution

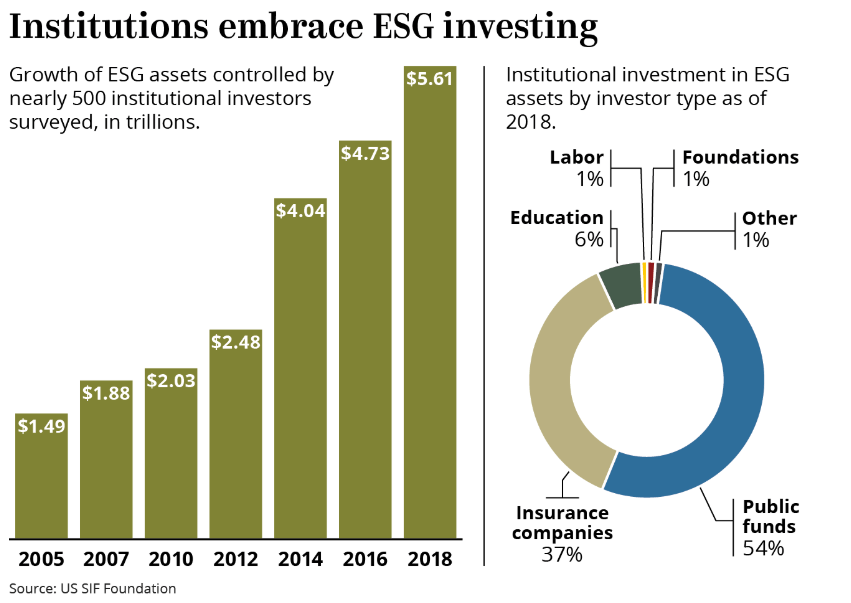

By the 2000s, the concept evolved into structured frameworks, most notably ESG (Environmental, Social, Governance) criteria. Today, trillions of dollars are managed under ESG guidelines.

The Role of ESG Criteria

ESG has become the cornerstone of ethical investing, providing a framework to evaluate companies beyond profits.

A. Environmental Standards

Companies are judged on their carbon emissions, pollution levels, use of renewable energy, and efforts to fight climate change. Investors want assurance that businesses are part of the solution, not the problem.

B. Social Responsibility

This includes fair treatment of employees, community engagement, diversity and inclusion policies, and respect for customer rights. Companies that exploit labor or neglect communities are penalized.

C. Governance Practices

Strong governance means accountability, ethical leadership, and transparency in financial reporting. Poor governance often leads to scandals, corruption, and financial collapse.

Benefits of Ethical Investing

Ethical investing does more than ease the conscience of investors—it delivers real advantages.

A. Positive Global Impact

By directing money toward clean energy, healthcare, and education, ethical investments drive meaningful change. They help fight climate change, reduce inequality, and improve living standards.

B. Financial Resilience

Companies with strong ESG scores tend to be more stable. They avoid risks like environmental fines, worker strikes, or fraud scandals, making them safer long-term investments.

C. Investor Satisfaction

Aligning investments with values creates personal fulfillment. Investors feel empowered knowing their money supports causes they believe in.

Challenges in Ethical Investing

Despite its promise, ethical investing faces obstacles that make it complex.

A. Inconsistent Standards

There is no universal definition of what qualifies as ethical. One rating agency may label a company “sustainable,” while another may not. This lack of clarity confuses investors.

B. Greenwashing Risks

Some companies exaggerate or misrepresent their environmental practices to attract investors. This practice, known as greenwashing, undermines trust in the system.

C. Profit vs. Purpose Dilemma

Ethical companies may not always deliver the highest short-term profits. Investors must sometimes choose between values and immediate gains.

Ethical Investment Strategies

There are several ways to integrate ethics into financial decisions.

A. Negative Screening

Excluding industries that conflict with ethical standards, such as weapons, fossil fuels, or adult entertainment.

B. Positive Screening

Seeking out companies that excel in sustainability, such as solar energy firms, fair-trade businesses, or organizations with diverse leadership teams.

C. Impact Investing

Investing directly in projects designed to create measurable positive outcomes, such as clean water initiatives, affordable housing, or microfinance programs.

Global Trends Driving Ethical Investing

The movement is not limited to a small group of investors; it is becoming a worldwide phenomenon.

A. Institutional Adoption

Pension funds, universities, and governments are incorporating ESG into their portfolios. Large financial institutions now manage trillions of dollars in ethical funds.

B. Millennial and Gen Z Influence

Younger generations, especially millennials and Gen Z, are demanding responsible practices. They prefer investing in companies that reflect their social and environmental concerns.

C. Technological Advancements

Digital platforms now provide investors with access to ESG data and tools for building ethical portfolios. AI-driven analysis further helps detect greenwashing.

Case Studies in Ethical Investing

Real-world examples demonstrate how ethical investing creates tangible impact.

A. Renewable Energy Growth

Companies in solar, wind, and hydro energy have attracted billions in investment, fueling a global transition away from fossil fuels.

B. Fair Trade Businesses

Fair trade coffee and clothing companies show how ethical practices can be profitable, attracting loyal customers and dedicated investors.

C. Tech Companies with Strong ESG

Some leading technology firms are investing heavily in renewable energy, diversity initiatives, and transparent governance, proving that innovation and responsibility can go hand in hand.

The Future of Ethical Investing

Looking forward, ethical investing is set to grow even more influential.

A. Integration into Mainstream Finance

ESG will no longer be optional—it will become a standard part of every investment decision.

B. Expansion of Sustainable Instruments

Green bonds, eco-friendly funds, and climate-focused portfolios will continue to multiply as investor demand grows.

C. Stricter Regulations

Governments worldwide are beginning to enforce stricter reporting requirements, ensuring that companies provide accurate data on sustainability efforts.

Conclusion

Ethical investing represents a powerful shift in the financial world, where money is not just a tool for personal gain but a driver of global progress. By prioritizing sustainability, human rights, and good governance, ethical investing creates a win-win situation: profit for investors and progress for society.

The rise of ethical investing signals a future where financial growth and moral responsibility go hand in hand. While challenges such as greenwashing and inconsistent standards remain, the momentum is clear—investors, companies, and governments are embracing a model where values and wealth align.